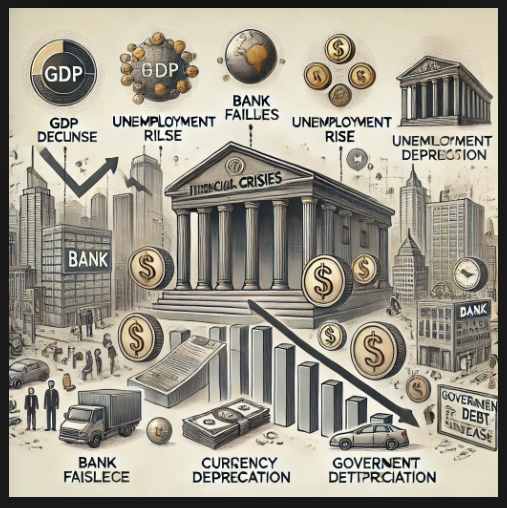

Financial crises can have devastating consequences on a country's economy, leading to long-term structural changes and widespread socio-economic challenges. This article explores the causes, short-term and long-term effects, and real-world examples of financial crises to understand their impact on an economy.

1. Causes of Financial Crises

Financial crises arise due to various factors, including:

Banking Failures: Poor risk management, excessive lending, and financial mismanagement can lead to bank collapses (e.g., 2008 Global Financial Crisis).

Stock Market Crashes: Sharp declines in stock values reduce investor confidence and wealth (e.g., 1929 Great Depression).

Debt Crises: Excessive government or corporate borrowing can lead to defaults (e.g., Greek Debt Crisis 2010).

Currency Crises: A rapid depreciation of a nation's currency can trigger economic instability (e.g., Argentina 2001).

External Shocks: Wars, pandemics, or commodity price collapses can create financial turmoil (e.g., COVID-19 pandemic effects in 2020).

2. Short-Term Effects of Financial Crises

a) Economic Contraction & Recession

GDP declines due to reduced business activity and lower consumer spending.

Example: The 2008 Global Financial Crisis led to a 4.3% contraction in the U.S. economy in 2009.

b) Rising Unemployment

Companies lay off workers to cut costs, increasing joblessness.

Example: Spain's unemployment rate soared to 27% after the 2008 crisis.

c) Banking System Disruptions

Liquidity shortages cause banks to collapse or require bailouts.

Example: Lehman Brothers filed for bankruptcy in 2008, triggering a banking panic.

d) Currency Depreciation and Inflation

A weakened currency makes imports expensive, leading to inflation.

Example: Argentina faced hyperinflation after its 2001 economic crisis.

e) Decline in Consumer & Business Confidence

People and businesses spend less, further deepening the crisis.

Example: After the 2008 crisis, consumer spending in the U.S. fell by 3%.

3. Long-Term Effects of Financial Crises

a) Slow Economic Recovery & Low Growth

It takes years to recover from a crisis due to lost investments and debts.

Example: Greece’s economy shrank by 25% between 2008 and 2013 due to austerity measures.

b) Higher Government Debt

Governments borrow heavily to finance stimulus programs and bailouts.

Example: The U.S. national debt increased by over $9 trillion after the 2008 crisis.

c) Structural Economic Changes

Governments introduce stricter financial regulations and policies.

Example: The Dodd-Frank Act (2010) was introduced in the U.S. to prevent future crises.

d) Increased Social & Political Instability

Economic hardship can lead to protests and political upheaval.

Example: The Arab Spring (2010-2012) was partially fueled by economic grievances.

e) Impact on Global Trade

Global trade slows as demand falls worldwide.

Example: After the 2008 crisis, global trade declined by 9% in 2009.

4. Case Studies of Financial Crises

Case Study 1: The 2008 Global Financial Crisis

Cause: Subprime mortgage lending, excessive risk-taking by banks, and housing bubble burst.

Effects: Massive job losses, bank bailouts, global economic slowdown.

Recovery: Government stimulus packages and monetary policies (e.g., quantitative easing).

Case Study 2: The Asian Financial Crisis (1997-1998)

Cause: Excessive borrowing and currency devaluations in Thailand, Indonesia, and South Korea.

Effects: GDP contractions, unemployment surges, IMF bailouts.

Recovery: Structural reforms and economic restructuring by affected nations.

Case Study 3: The Greek Debt Crisis (2010-2018)

Cause: High government debt, weak economic growth, and eurozone financial instability.

Effects: Severe austerity measures, unemployment reaching 27%.

Recovery: EU and IMF bailouts with strict financial oversight.

5. Strategies to Mitigate the Impact of Financial Crises

a) Strong Financial Regulations

Implementing policies to prevent excessive risk-taking by banks.

b) Effective Monetary & Fiscal Policies

Central banks can lower interest rates and introduce stimulus packages to boost growth.

c) Diversification of Economy

Reducing reliance on a single industry prevents economic collapse during downturns.

d) Strengthening Social Safety Nets

Providing unemployment benefits and support programs to affected citizens.

0 Comments